CBS News Live

CBS News Los Angeles: Local News, Weather & More

Watch CBS News

A memorial will take place Saturday for Rev. Dr. Cecil L. "Chip" Murray, the pastor of the First African Methodist Episcopal Church for 27 years.

A man was stabbed several times with a knife Friday after an argument on a Metro bus turned to violence, according to the Los Angeles Police Department.

No details about the latest "youth-on-youth violence" at Los Padrinos were released, but the disciplinary action comes after eight other officers were placed on leave in January.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

An emergency exit slide "separated" from a Delta flight Friday, prompting an emergency return to New York City's John F. Kennedy Airport.

A Southern California driver tried using the carpool lane with what authorities describe as a "next level" dummy.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

Anaheim police said a man who opened fire at an apartment complex killed a woman before ending his own life.

After meeting China's leader Xi Jinping, Antony Blinken says both sides agree that difficult discussions are essential to avoid "any miscalculations."

While it was nearly 32 years ago, Micah Stepanian still remembers the beautiful night with his friend Jeff Wilson. That beautiful night ended in tragedy, however, when a teen opened fire on the pair. Michele Gile reports.

We talk with J Edgar Boyd, former pastor of the First AME Church in Los Angeles where Murray served for 27 years. Boyd, who will be officiating the memorial service on Saturday, shared stories and talked about the legacy of Murray.

A man was stabbed several times with a knife Friday after an argument on a Metro bus turned to violence, according to the Los Angeles Police Department.

Located in downtown Hemet, the Hemet Museum shares the local history of the valley with exhibits ranging from Native American artifacts to displays about the citrus industry and early 20th-century life.

Michael Juliano, Time Out Los Angeles editor shares what's happening this weekend: Street Food Cinema at the Autry, EMEK: 30 Years of AAARGHT!, Pizza City Fest at LA Live, Puppet UP! Uncensored.

The Denver Nuggets moved to the brink of the second round with a 112-105 victory over the Los Angeles Lakers in Game 3 of their first-round series.

The Los Angeles Chargers drafted Notre Dame offensive lineman Joe Alt with the fifth pick in the NFL Draft.

It's a decision that has been widely projected as a virtual lock for this NFL Draft, especially after the Bears traded away Justin Fields to the Steelers.

Reggie Bush said getting back the Heisman Trophy was like being on the field again.

Anze Kopitar fired a wrist shot past Stuart Skinner's glove and into the top corner on a breakaway to give the Los Angeles Kings a 5-4 victory over the Edmonton Oilers on Wednesday night in Game 2 of the first-round playoff series.

Luka Doncic scored 32 points and the Dallas Mavericks overcame the return of Clippers superstar Kawhi Leonard to beat Los Angeles 96-93 and tie their Western Conference first-round playoff series at a game apiece.

Mike Trout hit his first leadoff home run since 2012, and the Los Angeles Angels defeated the Baltimore Orioles 7-4 to snap a five-game losing streak.

Shohei Ohtani hit a 450-foot homer to the second deck in right field in his first visit to Nationals Park, and the Los Angeles Dodgers beat Washington 4-1.

Zach Hyman had three goals and an assist in his first postseason hat trick, Connor McDavid had five assists and the Edmonton Oilers beat the Los Angeles Kings 7-4 in Game 1 of their first-round playoff series.

How much crime is there in our schools? How safe are our airports? You have the right to know these things through public records but, as Ross Palombo has found, the state has some serious issues with what they are and are not telling us.

"No teacher should have to lie as part of their job". Ross Palombo talks to a teacher in the Los Angeles Unified School who says he was told to lie about class attendance, which is how the state calculates funding from your tax dollars.

The CDC recommends that at least 95% of students have the MMR vaccine in order to lower the risk of measles outbreaks at their school, but a recent KCAL News investigation shows that hundreds of SoCal schools are well below that number.

For months, migrants have arrived in Los Angeles on controversial buses chartered from Texas. With a lack of coordination from the Lone Star state, community groups stepped in to help bring things under control and helped hundreds across Southern California.

Watts will raise awareness of serious issues impacting Californians, hold local officials accountable, obtain answers for viewers and provide solutions.

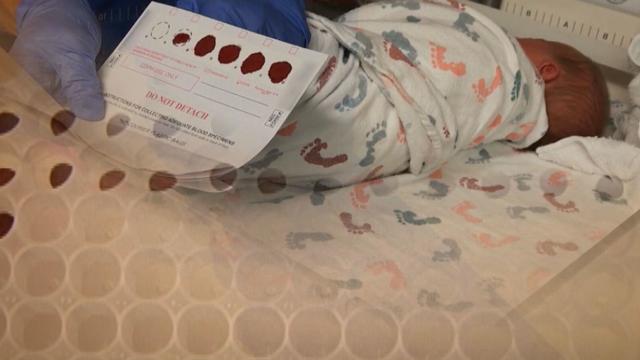

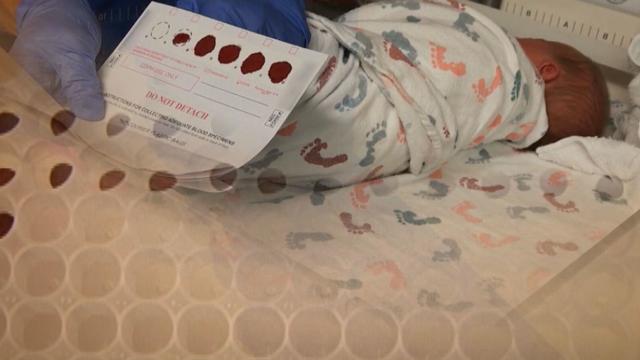

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

A bill introduced in the wake of our "Handcuffs in Hallways" investigation aims to reduce "unnecessary" calls for police at schools. But one California lawmaker could kill it without a vote.

A memorial will take place Saturday for Rev. Dr. Cecil L. "Chip" Murray, the pastor of the First African Methodist Episcopal Church for 27 years.

A man was stabbed several times with a knife Friday after an argument on a Metro bus turned to violence, according to the Los Angeles Police Department.

No details about the latest "youth-on-youth violence" at Los Padrinos were released, but the disciplinary action comes after eight other officers were placed on leave in January.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

An emergency exit slide "separated" from a Delta flight Friday, prompting an emergency return to New York City's John F. Kennedy Airport.

A memorial will take place Saturday for Rev. Dr. Cecil L. "Chip" Murray, the pastor of the First African Methodist Episcopal Church for 27 years.

A man was stabbed several times with a knife Friday after an argument on a Metro bus turned to violence, according to the Los Angeles Police Department.

No details about the latest "youth-on-youth violence" at Los Padrinos were released, but the disciplinary action comes after eight other officers were placed on leave in January.

A district letter to parents and the school community said that the video was brought to the attention of both the district and law enforcement Thursday night.

Wynne Lee was sentenced Friday to four years for the accessory after the fact charge, but since she already served time with home confinement and electronic monitoring, she was released Friday from custody.

Anaheim police said a man who opened fire at an apartment complex killed a woman before ending his own life.

Police say that the incident began as a fight between roommates but escalated into a physical altercation early Sunday.

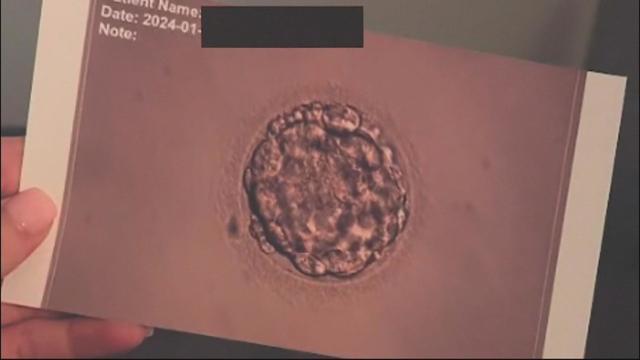

Nine Southern California couples have filed a lawsuit accusing the Ovation Fertility lab of negligence and recklessness.

Officers pulled over Jamie Rodgers after the dealership accidentally reported the car they loaned to him as stolen.

One person has died and two others were injured in a single-vehicle crash in Santa Ana.

Vector control specialists hope this will reduce the mosquito population without deploying pesticides and chemicals.

A 21-year-old mother is luckily sitting in her home with her two children after she was ambushed and shot in the face outside an Apple Valley gas station last week.

The bust was part of a year-long operation dubbed "Hotline Bling."

San Bernardino County deputies arrested multiple people for trying to steal from a freight train at the Cajon Pass in what resembled a scene from an old western movie.

The Santa Clarita Valley Sherriff's Department received reports of a man with long hair shooting BB guns, and "windows have been shattered."

"No teacher should have to lie as part of their job". Ross Palombo talks to a teacher in the Los Angeles Unified School who says he was told to lie about class attendance, which is how the state calculates funding from your tax dollars.

The CDC recommends that at least 95% of students have the MMR vaccine in order to lower the risk of measles outbreaks at their school, but a recent KCAL News investigation shows that hundreds of SoCal schools are well below that number.

For months, migrants have arrived in Los Angeles on controversial buses chartered from Texas. With a lack of coordination from the Lone Star state, community groups stepped in to help bring things under control and helped hundreds across Southern California.

KCAL senior reporter Ross Palombo gets an unprecedented look into the tactics the LAPD uses to stop retail theft.

A federal court ruling involving a controversial arrest within Moreno Valley Unified School District could lead to big changes in school policies nationwide.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

An emergency exit slide "separated" from a Delta flight Friday, prompting an emergency return to New York City's John F. Kennedy Airport.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

The Denver Nuggets moved to the brink of the second round with a 112-105 victory over the Los Angeles Lakers in Game 3 of their first-round series.

Former National Enquirer boss David Pecker appeared on the stand for the third day, detailing an agreement the tabloid made with a former Playboy model.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

After meeting China's leader Xi Jinping, Antony Blinken says both sides agree that difficult discussions are essential to avoid "any miscalculations."

Former National Enquirer boss David Pecker appeared on the stand for the third day, detailing an agreement the tabloid made with a former Playboy model.

Gavin Newsom was asked to comment about Harvey Weinstein's 2020 rape conviction being overturned on Thursday, and the California governor didn't mince words.

Target, looking for ways to add sales, is relaunching its Target Circle loyalty program including a new paid membership with unlimited free same-day delivery in as little as an hour for orders over $35.

When, who and how much to tip is becoming more of a question in consumers' minds.

One in four college students says they have credit card debt, according to a new survey by U.S. News and World Report. And with interest rates topping 20 percent, those students could be in debt for years. On Your Side's Kristine Lazar has more on the biggest mistakes college students are making with their credit cards.

Fewer than a third of Americans have a will. Experts say that could lead to confusion and money loss when someone dies without one. On Your Side's Kristine Lazar has expert tips on who needs a will and how to create one.

Choosing random numbers increases your chances of not having to split the prize money should you win.

California law says genetic testing companies have to get your permission before they store, use or sell your DNA, but the state itself doesn't have to get your permission and has been storing DNA samples from every baby born there since the '80s. Lawmakers want to change that, but face an uphill battle.

Fentanyl test strips used to be illegal in California. Now, state law requires them on community and state college campuses and they're popping up everywhere from vending machines to bars. They're intended to help young people avoid fentanyl-laced counterfeit prescription pills and tainted recreational drugs. But as fentanyl test strips are normalized – from high school to college to bachelor parties – experts warn test strips alone can provide a false sense of security, and in some cases do more harm than good. We put fentanyl test strips to the test, and what we found could save someone you know.

Dr. Gary Gibbon is now cancer-free, six months after the first-ever lung-liver transplant on a cancer patient.

Preventative chemotherapy, which is usually referred to as "adjuvant chemotherapy," is an early treatment that is used to reduce the chances of cancer returning.

Actress Olivia Munn's cancer diagnosis is raising awareness for women to seek additional screening for breast cancer after her traditional testing failed to show any signs.

Robotaxis are hitting the streets of Los Angeles.

Disney is seeking approval from local officials to expand its California theme park offerings over the next four decades.

Target, looking for ways to add sales, is relaunching its Target Circle loyalty program including a new paid membership with unlimited free same-day delivery in as little as an hour for orders over $35.

Southern California Edison will pay $80 million to settle claims on behalf of the U.S. Forest Service connected to a massive wildfire that destroyed more than a thousand homes and other structures in 2017.

As he closes in on the Republican presidential nomination, former President Donald Trump made a highly unusual stop.

The Denver Nuggets moved to the brink of the second round with a 112-105 victory over the Los Angeles Lakers in Game 3 of their first-round series.

The Los Angeles Chargers drafted Notre Dame offensive lineman Joe Alt with the fifth pick in the NFL Draft.

It's a decision that has been widely projected as a virtual lock for this NFL Draft, especially after the Bears traded away Justin Fields to the Steelers.

Reggie Bush said getting back the Heisman Trophy was like being on the field again.

Anze Kopitar fired a wrist shot past Stuart Skinner's glove and into the top corner on a breakaway to give the Los Angeles Kings a 5-4 victory over the Edmonton Oilers on Wednesday night in Game 2 of the first-round playoff series.

Harvey Weinstein's 2020 conviction on felony sex crime charges has been overturned by the State of New York Court of Appeals.

Taylor Swift fans have found a way to feel "a little bit closer to" their hero at a London watering hole, and The Black Dog pub is lapping it up.

The Spice Girls had a reunion on Saturday and even put on an impromptu performance.

Roman Gabriel, the former North Carolina State quarterback who was the 1969 NFL MVP with the Los Angeles Rams, has died.

The singer was found deceased at her home, a representative said.

While it was nearly 32 years ago, Micah Stepanian still remembers the beautiful night with his friend Jeff Wilson. That beautiful night ended in tragedy, however, when a teen opened fire on the pair. Michele Gile reports.

We talk with J Edgar Boyd, former pastor of the First AME Church in Los Angeles where Murray served for 27 years. Boyd, who will be officiating the memorial service on Saturday, shared stories and talked about the legacy of Murray.

A man was stabbed several times with a knife Friday after an argument on a Metro bus turned to violence, according to the Los Angeles Police Department.

Located in downtown Hemet, the Hemet Museum shares the local history of the valley with exhibits ranging from Native American artifacts to displays about the citrus industry and early 20th-century life.

Michael Juliano, Time Out Los Angeles editor shares what's happening this weekend: Street Food Cinema at the Autry, EMEK: 30 Years of AAARGHT!, Pizza City Fest at LA Live, Puppet UP! Uncensored.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

The Academy Awards will hand out filmmaking's top honor in 23 categories during the 2024 Oscars at the Dolby Theatre in Hollywood, starting at 7 p.m. Eastern, 4 p.m. PDT.

Shots from the PGA's Genesis Invitational golf tournament held at the Riviera Golf Club in the Pacific Palisades.

Even a potentially historic storm bearing down on California couldn't keep the stars away from the red carpet ahead of the 66th Grammy Awards in Los Angeles.

Who are your favorite celebrities wearing for the 2024 Golden Globe Awards? Check out our red carpet fashion photo gallery!